property tax on leased car massachusetts

The property tax is collected by the tax collectors office in the countycity in which the vehicle is registered. People leasing cars in the selected states that levy local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise.

Do You Pay Sales Tax On A Lease Buyout Bankrate

MA property tax is based on value of the car and would be the same whether you owned or leased the car.

. The taxing collector dictates the tax amount owed and the. Property tax on leased car in ma. Ga Liens Forsyth Tax.

Taxes registration fees and. Youll have to pay upfront lease costs which usually include. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. Liability insurance with coverage requirements of 10000030000050000. If your vehicle is leased the leasing company as owner is responsible for applying for the abatement.

4 Dirty Little Secrets About the Personal Property Tax Massachusetts Leased Car Industry. If the current year tax bill has not been received but the payoff will occur after the assessment date the leasing company needs to include an estimated. Property tax on leased car in ma.

Every motor vehicle is subject to. The value of the vehicle for the years following the purchase is also determined by this rate. The state-wide tax rate is 025 per 1000.

A capitalized cost reduction and. Leased and privately owned cars. Your first months payment.

This page describes the. In California the sales tax is 825 percent. Please contact your leasing company regarding any refund which.

The excise rate is 25 per 1000 of your vehicles value. This page describes the. Comprehensive fire and theft insurance usually with a maximum deductible of 500 to 1000.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. So if you live in a state with a. According to the Connecticut Department of Motor Vehicles DMV you must pay a 675 percent sales tax or 825 percent sales tax on vehicles over 50000 when you buy a vehicle from a.

Leasing Vs Buying A Car Pros And Cons Travelers Insurance

Massachusetts Auto Sales Tax Everything You Need To Know

Sales Taxes In The United States Wikipedia

Which U S States Charge Property Taxes For Cars Mansion Global

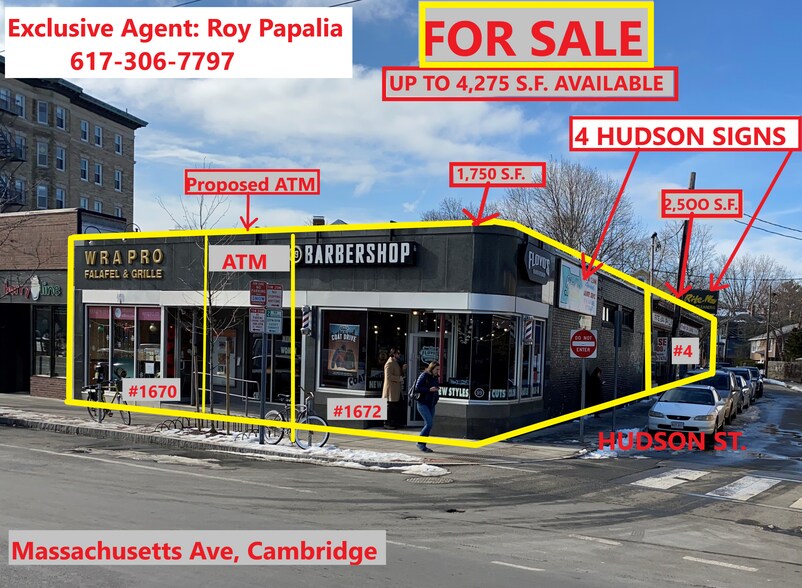

1670 Massachusetts Ave Cambridge Ma 02138 Retail For Sale Loopnet

Used Cars In Massachusetts For Sale Enterprise Car Sales

How To Get A Dealer License For Car Auctions Dealer Auction License Acv Auctions

Is It Better To Buy Or Lease A Car Taxact Blog

Can Landlords Really Ban Marijuana Edibles Usually Not But That Hasn T Stopped Them From Trying The Boston Globe

An In Depth Look At The Massachusetts Rental Market September Edition

Understanding Tax On A Leased Car Capital One Auto Navigator

Cis Motor Vehicle Excise Information

Leasing A Car And Moving To Another State What To Know And What To Do

Is It Better To Buy Or Lease A Car Taxact Blog

How To Lease A Car In Massachusetts Pocketsense

How Much It Costs To Own A Car In Every State 2022

Leasing A Car And Moving To Another State What To Know And What To Do